ChatGPT vs. Google: Who is winning the search showdown?

23 April 2025 Blog Posts

As leaders in the technical organic search space, we often get asked by clients, “how do LLMs compare to Google for searches?”

To find out, we conducted a study with help from our AI Division, a team focused solely on technological innovation and analysed data from 54 Megantic clients. By mining real‑world search traffic, we pinpointed where shoppers are starting their product hunt and what that reveals about emerging buying trends in the future of ecommerce.

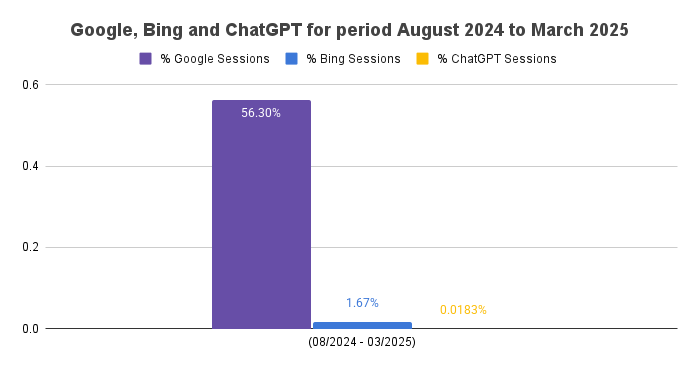

Google, Bing and ChatGPT for period August 2024 to March 2025

So what does the data tell us?

The graph above shows the percentage of user sessions attributed to three different search platforms — Google, Bing, and ChatGPT during the time period August 2024 to March 2025. Unsurprisingly, though perhaps we expected to see slightly less of a commanding lead, Google Organic Search still provides vastly more traffic than any other source at 56.3%.

Reasons for this might include:

- Large language models (LLMs) like ChatGPT still fall short when it comes to regionalising results – especially for location-specific needs like local stock availability or delivery logistics.

- Google still has market dominance because of it’s decades of infrastructure, data, and user behaviour insights behind it – remains the go-to search tool for billions of people worldwide.

- ChatGPT is great for the “thinking” phase, but Google still owns the “doing” phase – particularly evident when consumers are ready to act or make a purchase.

Our findings indicate that almost half of all ecommerce sessions still start on Google, and while large‑language models like ChatGPT are having a huge impact on the way people research new ideas; the entry point is driven more by curiosity. Until ChatGPT can reliably deliver locally relevant, product‑specific results, Google will be the reigning king of eCommerce search.

Read Megantic’s in-depth study below:

Is SEO dying?

That’s the big question circulating across the industry. People in ecommerce want to know if it’s it changing a lot, or very little? Especially in the Australian online retail where after a challenging period, finally experienced a year of growth in 2024, and while cost of living remains high, and tariff talk creates uncertainty, brands are chasing more efficient marketing and any edge in the market where possible.

The big question here isn’t so much is SEO dying due to AI – it’s ‘how is the way consumers shop online changing?’ And more importantly, are ‘new technologies like ChatGPT replacing traditional search engines like Google when it comes to making a purchase?’

Inspired by an article by SEJ, “ChatGPT Referral Traffic To Publishers Remains Minimal” which examined the impact of ChatGPT’s web search feature on referral traffic to news publishers. We set out to answer similar questions in our own market by looking closely at the platforms, devices, and experiences influencing purchasing decisions and where our clients’ traffic is actually coming from.

Traditional Search vs Large Language Model (LLM)

People can turn to AI platforms for pretty much anything; every day new stories emerge about how AI has been helpful to someone in a breakup text with their partner, a resume refresh or lately turning them into a superhero in a box. Beyond these personal uses – AI also powers practical features like personalised product recommendations.

The biggest difference between the two leading technologies when product surfing is the user experience – ChatGPT has long been praised for its natural flow. It feels like chatting with a knowledgeable assistant, you get conversational answers which leads to better productivity and idea generation. Whilst Google presents differently; showing a mix of paid and organic search results in the form of clickable links, shopping listings, and local stores where a product can be purchased.

Side by side comparison

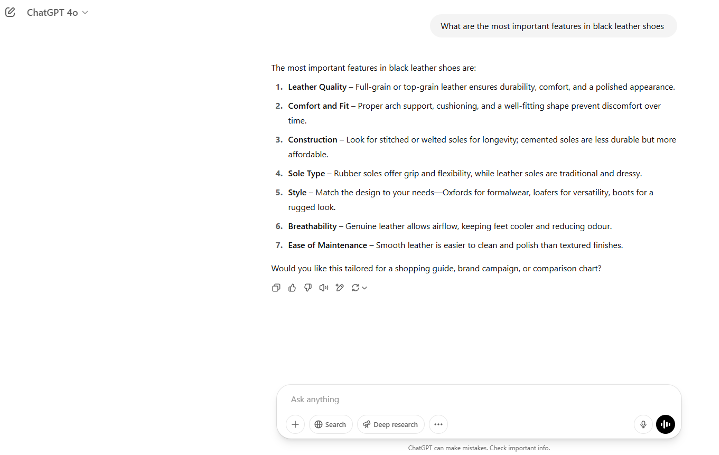

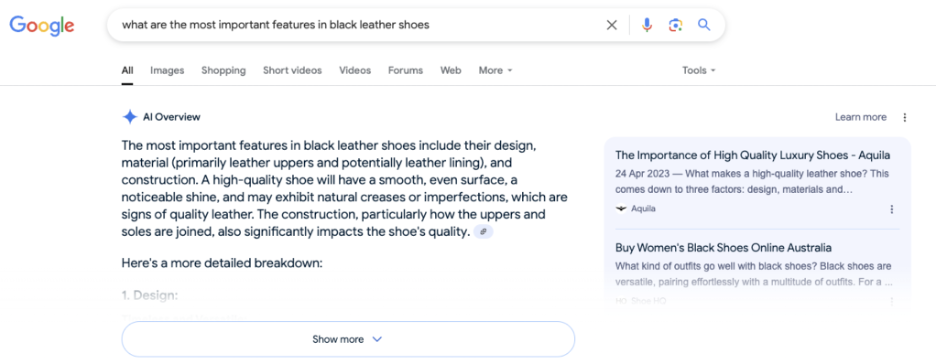

To test the search experience, we asked both platforms to respond to the query: ‘What are the most important features in black leather shoes?’.

This allowed us to assess how each platform interprets intent, structures responses, and supports the path to purchase.

A ChatGPT result for the query ‘What are the most important features in black leather shoes’

A Google – Gemini result for the query ‘What are the most important features in black leather shoes’

Above, we see a long tail informational query in Google’s AI assistant – Gemini featuring an article by Megantic client – Aquila in the referrals space.

Side note: If you’re trying this at home, you might note that in the Google SERP, you are provided with Gemini reasoning. Google’s Gemini was launched to rival AI players like OpenAI’s ChatGPT and Perplexity. It offers advanced reasoning, multimodal capabilities (text, images, code), and is integrated across Google’s ecosystem. It’s being positioned as both a standalone chatbot and a productivity assistant, and in October 2024, we saw Google expanding its generative AI Overviews to 100+ countries (including Australia) and enhancing Google Shopping with more personalised recommendations.

ChatGPT vs Google

We took a closer look at the UX and function of each:

|

|

Chat GPT |

|

|

Real-Time Info |

Excels at live updates like product stock, store hours, and breaking news. |

Limited access to real-time data unless connected to plugins or tools |

|

Purpose & Primary Use |

Google is a search engine. Its primary job is to find relevant websites, images, news, or videos in response to user queries by indexing the web. |

Acts like a virtual assistant or conversation partner. It’s designed to generate text, answer questions, help with writing, summarising, brainstorming, coding, and more in a natural, human-like way. |

|

How They Work |

Crawls billions of web pages constantly and ranks results based on relevance, freshness, authority, and SEO best practices. It points you to sources, not the answers themselves. |

Trained on large datasets (not live data) and responds based on patterns in language. It doesn’t search the internet in real time unless browsing tools are enabled. |

An important key difference is that ChatGPT rarely includes clickable links, and so there’s limited opportunity for websites to receive traffic, even when their content informs the AI’s responses. Hiding or removing links is done by ChatGPT to reduce the noise and keep replies short and punchy. If you’ve used the platform before (and we’re betting you have), you’ll notice their output is primarily text. For now, retailers cannot optimise their search on ChatGPT or buy ad placement the same way they can with SEO or paid search, making ROI hard to prove.

Growth data

We took a deep dive into three clients, all from different industry niches to look at not just the referral traffic volume from AI sources, but how it’s changing over time.

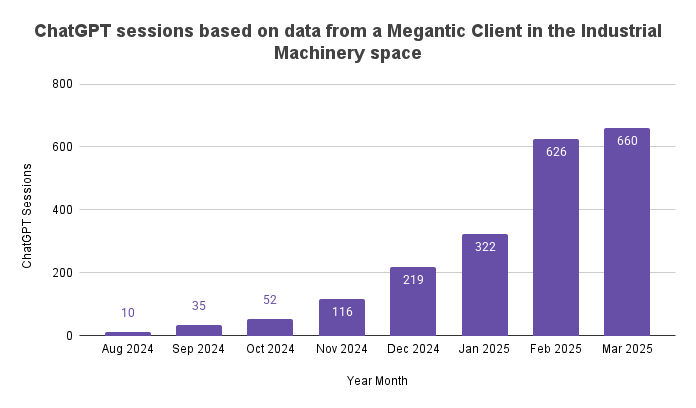

ChatGPT sessions based on data from a Megantic Client in the Industrial Machinery space

This Megantic Client experienced the a large rise in session count, surging by 6500% from August (10) to March (660), reflecting a late but rapid adoption curve likely driven by complex B2B queries and increased AI integration in industrial workflows.

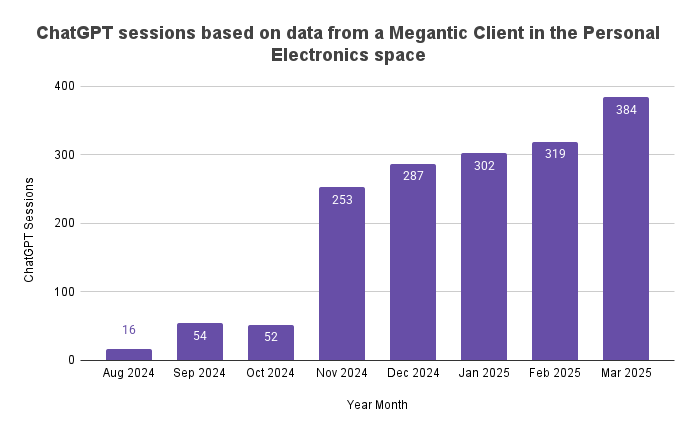

ChatGPT sessions based on data from a Megantic Client in the Personal Electronics space

This Megantic client saw a huge increase as well, and strong month-on-month growth suggesting rising consumer trust in AI for tech product research and purchase decisions. All data pointing to the fact that this curve would continue to increase upwardly.

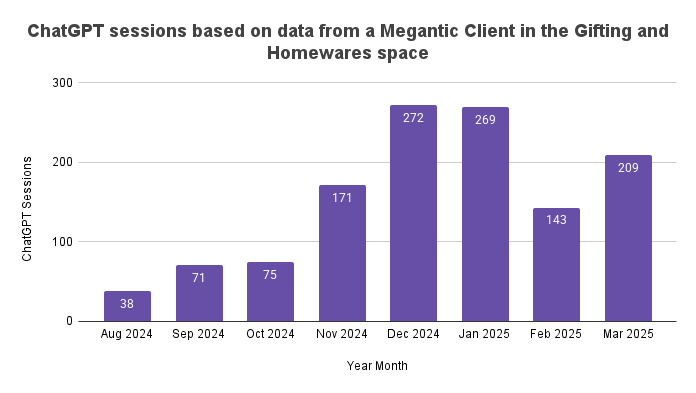

ChatGPT sessions based on data from a Megantic Client in the Gifting and Homewares space

Gifting & Homewares sessions grew by 450% from August to December 2024, peaking during the holiday season before dipping post-Christmas and rebounding in March—highlighting the very same seasonal usage patterns we see for in Google and other search platforms.

While ChatGPT adoption is growing rapidly—particularly for our client in the Industrial Machinery space, where sessions jumped from just 10 in August to 660 in March—it still represents a very small share of total traffic. Based on our dataset, Google likely drove around 2,031,498 sessions in March 2025 alone, compared to just 660 sessions via ChatGPT.

|

Channel |

Share of sessions |

|

|

56.3% |

|

Bing |

1.67% |

|

ChatGPT |

0.0183% |

This reinforces that while ChatGPT usage is growing fast, it’s still tiny in volume relative to dominant channels like Google.

Could ChatGPT replace Google Bing?

A heavily tongue in cheek title, sure, but a question that deserves more than a passing thought. AI is definitely here to stay, if it’s not a core part of a brand’s go-to-market strategy in 2025 they’ll be left behind. However, there’s no need to throw the baby out with the bathwater here either, while traffic sources like ChatGPT are rising rapidly, Google still dominates, with Bing a distant second – and many brands rightly invest very very little in their Bing strategy due to its scale.

An April 2025 Pew Research Center survey showed that roughly 66% of U.S. adults have never used ChatGPT. It’s important to remember that while the search landscape is shifting quickly, the consumer base moves much slower than the tech community and early adopters, and budgets should be tempered appropriately with this in mind.

Closing remarks

While ChatGPT is not yet disrupting web traffic at scale, its growing role in information discovery is pushing the industry to rethink how people access and value content. All three businesses we analysed saw exponential growth in visitors arriving via ChatGPT, confirming that AI-driven search is becoming a valuable traffic source. ChatGPT is redefining how we discover information online, but Google still dominates—most consumers continue to rely on traditional search for product browsing, especially when they’re ready to buy.